Why Emerging Markets Must Remain Wary of a Taper Tantrum 2.0

On September 22, the US Federal Reserve signaled plans to start reducing its large-scale asset purchases – a process known as tapering – this year and hinted at raising interest rates as early as next year. The formal announcement on tapering could come at the next meeting of the Federal Open Market Committee (FOMC) scheduled in early November if no major risks materialize and the Fed achieves its maximum employment and price stability goals. “If progress continues broadly as expected, the Committee judges that a moderation in the pace of asset purchases may soon be warranted,”[1] said the post-meeting statement issued by the FOMC. At his post-meeting news conference, Fed Chairman Jerome Powell affirmed that the tapering process “could come as soon as the next meeting”[2] and conclude by mid-2022.

The tapering process represents the first big step towards the normalization of monetary policy in the US following the outbreak of the COVID-19 pandemic. Once the tapering process is completed, the Fed would proceed with policy rate hikes and downsize its balance sheet, which currently stands at $8.2 trillion.

Similar to his Jackson Hole speech on August 27, Powell underlined the need to delink the tapering process from interest rate hikes in his press conference. He stated: “The timing and pace of the coming reduction in asset purchases will not be intended to carry a direct signal regarding the timing of interest rate liftoff for which we have articulated a different and substantially more stringent test.”[3]

Despite repeated attempts by Powell and other Fed officials to delink interest rate liftoff from tapering, many questions loom large: What if the Fed decides to hike interest rates earlier than what it is currently projected? What if the timing of the Fed’s decision and miscommunication around it triggers panic selling in the markets? Would we not then see a repeat of the 2013 “taper tantrum”?

Quantitative Easing and its Unintended Consequences

To contain the economic fallout of the COVID-19 pandemic, the Federal Reserve took a broad array of actions, including expansionary policy (slashing policy rates to near zero) and Quantitative Easing (large-scale buying of bonds and securities).

The Fed has been purchasing $120 billion ($80 bn of treasury securities and $40 bn of mortgage-backed securities) every month since March 18, 2020, to support the US economy. In the aftermath of the 2008 global financial crisis, the US Fed also ran a similar quantitative easing program through which it bought trillions of dollars in long-term securities during 2009-14.

The Fed buys such assets to induce liquidity into the economy. The increased money supply helps lower interest rates and encourages businesses to expand investments and consumers to consume more, thereby increasing aggregate demand. However, the central bank expands its balance sheet and runs the risk of higher inflation by doing so.

On the other hand, growing evidence suggests a positive correlation between a QE program and a booming stock market. Critics have questioned the effectiveness of QE on the grounds that massive cash injection is not channeled into productive investment avenues but to speculative activities in the stock markets, thereby causing a boom in the stock market. A low-interest-rate environment is generally more beneficial for stocks than bonds and fixed-income investments.

Since stock ownership is highly concentrated among the wealthy and asset-rich class, the QE programs tend to benefit them when asset prices go up. Put simply, the benefits of QE are often reaped more by financial investors than non-investors.

What Happens Next?

Once the US Fed takes the lead towards unwinding QE program, many central banks from advanced economies — and some in emerging markets too — would follow suit as they had also launched similar programs following the outbreak of the COVID-19 pandemic.

The ECB has recently announced a reduction in net asset purchases under the Pandemic Emergency Purchase Programme introduced in March 2020, while its traditional Asset Purchase Programme would continue. On September 23, the Bank of England’s monetary policy committee indicated that recent price developments had strengthened the case for a “modest tightening of monetary policy.”

Among the G10 countries, Norway’s central bank has announced a hike in interest rates on September 23. Small advanced economies such as South Korea and Iceland have also raised interest rates in recent months.

The upcoming reversal of QE programs in advanced economies would result in sucking out ample liquidity from the global financial markets. Since the US Fed buys $120 bn of bonds each month, the tapering process would alter the supply and demand dynamics and could potentially induce short-term volatility in certain market segments such as long-dated bonds and fixed income assets.

The prospects of the US Fed hiking interest rates sooner than later could prove highly disruptive to emerging markets as global investors are likely to pull out money from the riskier EM assets and invest into “safe-haven” assets, similar to the infamous 2013 “taper tantrum” episode.

2013: The Year of the “Taper Tantrum” 1.0

During an appearance before the US Congress’s Joint Economic Committee on May 22, 2013, the then-Fed Chairman, Ben Bernanke, spoke about the possibility of scaling back asset purchases program (QE3) launched in response to the 2008 global financial crisis.

His statement triggered one of the most turbulent phases in the global financial markets as investors interpreted Bernanke’s statement as an impending end to Fed’s highly accommodative monetary policy. Investors started panicking, bond yields shot up, and stock prices dropped. Despite subsequent attempts by Bernanke and Powell[4] to reassure investors that interest rate hikes were still far off and should not be linked with the tapering process, the taper talk prompted investors to sell riskier assets for safety of bonds in the US markets.

The disruptive impact of the market frenzy was not only limited to the US markets. It was more pronounced in emerging markets that experienced sharp reversals of capital inflows, resulting in sizable currency depreciation. In particular, the turbulence was felt most in the “fragile five” EMEs — South Africa, Brazil, India, Indonesia, and Turkey. These economies had high current-account deficits, and a strong dependence on foreign capital inflows made them vulnerable to sudden stops in capital inflows.

Before 2013, these EMEs had received large capital inflows thanks to the ultra-loose monetary policy of the US Fed. The foreign investors borrowed cheap money in the US and invested in higher-yielding assets in India, Indonesia, South Africa, and other emerging market and developing economies (EMDEs). But when Bernanke raised the possibility of tapering and financial tightening, investors dumped EM financial assets en masse and moved their capital to safe-haven assets in developed markets. This episode of sharp market frenzy was dubbed the “taper tantrum.”

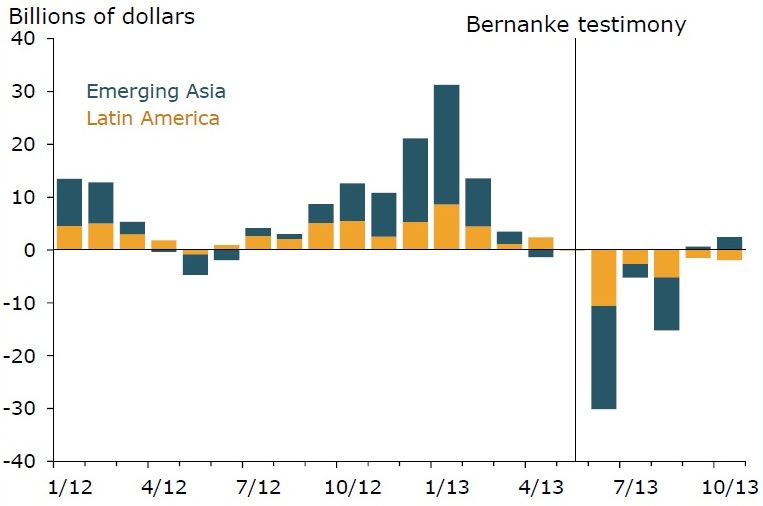

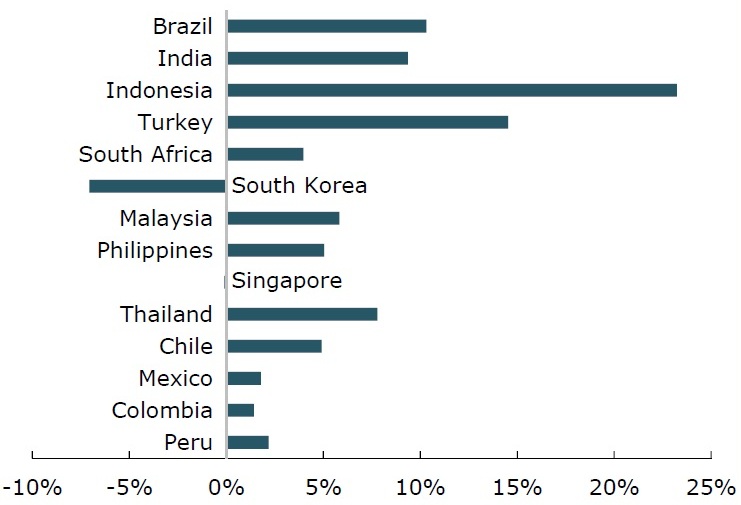

As indicated in Figure 1 and 2, several Asian and Latin American EMs experienced sharp reversals in capital inflows, resulting in sizeable currency depreciation. For instance, in the Indian debt and equity markets, foreign investors pulled out $10 bn from during June-July 2013.

Figure 1: Emerging Markets Bond and Equity Fund Flows (2012-13)

Sources: Jerome Powell and Fernanda Nechio.

Figure 2: Exchange Rate Depreciation (May-December 2013)

Source: Bloomberg, 2014.

The 2013 taper talk episode is a timely reminder that even the mere suggestion of reducing monetary stimulus could be hugely disruptive for EMDEs because global investors are hypersensitive to changes in the Fed’s monetary policy stance.

Why EMDEs Cannot Afford a Taper Tantrum 2.0 in 2021-22

Looking to the year ahead, the billion-dollar question is whether EMDEs would experience a repeat of the 2013 “taper tantrum”? Some market watchers argue that EMDEs may not experience a similar episode in 2021-22 because domestic and global economic environments have changed in the last eight years. However, such arguments miss an important distinction: the rapid deterioration in economic fundamentals in the post-COVID-19 period makes EMDEs particularly vulnerable to external shocks emanating from financial tightening in the advanced economies.

The uneven global distribution of COVID-19 vaccines has led to most EMDEs lagging behind their advanced peers. The slow pace of vaccinations in EMDEs makes them increasingly vulnerable to new waves of infection and the spread of virus variants. The risk of future lockdowns is holding back investment and consumption, thereby delaying the economic recovery in EMDEs.

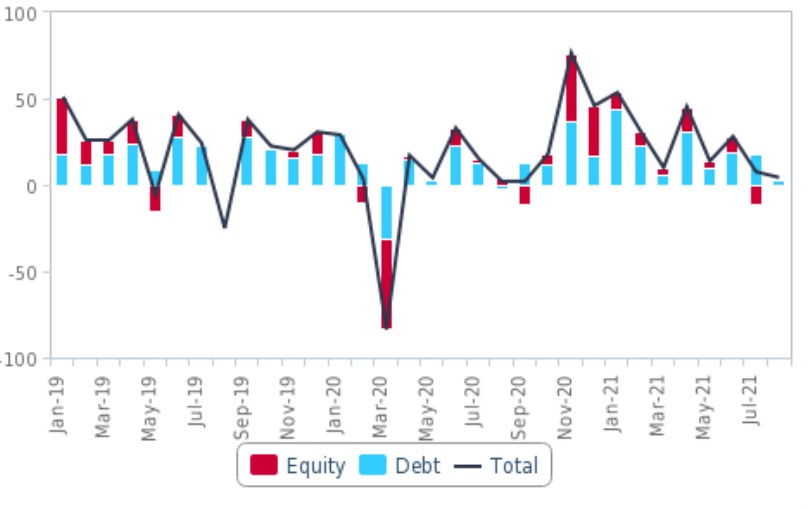

Because of the global financial interconnectedness, the eventual normalization of monetary policy in the US and major advanced economies could pose significant financial stability risks in the EMDEs. These risks are especially prominent in EMDEs with low foreign exchange reserves, large external refinancing needs, significant dollarized banking systems, thin domestic financial markets, and higher current account deficits. Since December 2020, net capital inflows into emerging markets are slowing down (Figure 3).

There is no denying that the timing and pace of policy normalization matter. Still, a rise in US yields and interest rates reflecting heightened concerns about inflation could trigger large capital outflows from emerging markets.

Figure 3: Emerging Markets: Net Capital Inflows ($bn)

Source: Institute of International Finance and Fitch.

Why? Because global investors who had borrowed money in US dollars at near-zero interest rates to invest in EMDEs would sell off their financial assets in these economies en masse and move their capital to “safe-haven” assets. The selloffs would put depreciating pressures on EMDE currencies because foreign investors would convert domestic currency-denominated investments into the US dollar and other foreign currencies.

A rapidly depreciating domestic currency will prompt even more investors to pull out their money as they may fear domestic currency falling further. This could eventually result in a run on the domestic currency, thereby perpetuating a currency crisis.

In response, the EMDE central banks may have to raise the interest rates to defend the home currency even though the domestic economic conditions may not warrant a rate hike. Hence, EMDEs face the risks of repeating the currency crises witnessed in the 1980s and 1990s coupled with an increase in inflation via exchange rate pass-through.

Little Room to Maneuver

Significant inflation pressures have emerged across EMDEs due to higher commodity prices, supply chain disruptions, and weaker exchange rates. In particular, rising food prices have a significant impact on headline inflation as food expenditures represent more than 30 percent of the consumption basket in many EMDEs.

A persistently elevated inflation poses a major vulnerability for EMDEs because foreign investors are concerned about inflation-adjusted returns. High levels of inflation lower the inflation-adjusted return on investments and make EMDEs less attractive to foreign investors.

That’s why several EMDE central banks are inching towards monetary policy normalization to address both domestic inflation pressures and exchange rate developments. The central banks of Brazil, Russia, Mexico, and Chile have hiked policy rates in recent months.

Higher interest rates are problematic too. Higher rates contribute to higher debt service costs, leading to heightened debt sustainability concerns in the EMDEs.

Most EMDEs have little room to maneuver macroeconomic policies because of the limited credibility of their currencies. Their fiscal situation has rapidly deteriorated after the outbreak of the COVID-19 pandemic. Since then, the EMDE governments have stepped in to tackle the virus, enhance health expenditures and provide relief to households and businesses.

Unlike advanced economies, most EMDEs have not engaged in strong fiscal interventions due to limited fiscal space. Instead, their governments adopted a fiscal-monetary policy mix to cushion the economic fallout of the pandemic.

Nevertheless, with tax revenues down and public expenditures soaring, the budget deficits of EMDEs have increased. Their governments borrowed heavily from domestic and external sources to overcome the COVID-19-induced recession. According to data compiled by Fitch Ratings, the median EM total government debt rose from 34 percent of GDP at end-2012 to 62 percent at end-2020, making these economies more sensitive to higher global and local interest rates. As EMDE public debt levels are forecast to increase in 2021-22, it would further weaken their ability to respond to future economic shocks.

Similarly, a substantial rise in foreign currency borrowings by EMDE sovereigns and non-financial since 2013 makes domestic currency depreciation more problematic for these economies.

Besides, there are risks to social and political stability too. The EMDEs would find it challenging to hike indirect taxes or withdraw fiscal support to vulnerable households in the near term as the pandemic has further worsened the income inequality. That poses an additional risk of widespread social unrest, as witnessed in South Africa, Colombia, and Chile in recent months.

Growing External Debt Vulnerabilities

While debt-to-GDP and debt service ratios are useful economic indicators, the currency composition of debt along with exchange rate vulnerability provide a better understanding of a country’s financial fragility in the context of exogenous financial shocks.

Unlike low-income countries that rely on concessional loans and aid to meet their external financing needs, most EMDEs raise money through issuing foreign-currency bonds in the international capital markets. Despite market turmoil during March-May 2020, many big emerging markets have raised resources via foreign currency-denominated bonds in global markets over the past year, albeit at a higher premium.

However, a sudden stop in capital flows could trigger an external debt crisis in EMDEs if they have a large stock of foreign currency-denominated debt and low forex reserves. Put simply, the higher the size of the foreign currency-denominated debt, the higher the likelihood of a debt crisis during risk-off events. Hence, EMDE sovereigns and corporates that have issued large foreign currency bonds need to watch out once capital flows reverse.

Even if sovereign and corporate bonds are issued in domestic currency, foreigners’ sizeable ownership of such financial instruments could transmit external financial shocks in EMDEs, as witnessed during the panic March-May 2020.[5]

During sudden stop events, the EMDE banks having high exposure to foreign currency loans or reliant on foreign currency funding would face additional pressures in terms of higher foreign currency funding costs and rise in non-performing loans due to unhedged foreign currency loans corporates, and lower profitability prospects. In particular, African countries with dollarized banking systems need to watch out. Close to 90 percent of bank deposits and loans are denominated in the US dollar in the Democratic Republic of the Congo, 42 percent in Angola, and more than 30 percent in Tanzania, Uganda, and Namibia. Approximately 25 percent of the banking system in Nigeria, Ghana, and Egypt is dollarized.[6]

The weakening of domestic currencies would further complicate the debt sustainability of EMDE debt levels because currency depreciation would automatically increase the stock of foreign-exchange-denominated liabilities in domestic currency.

Already six countries – Argentina, Ecuador, Belize, Lebanon, Suriname, and Zambia – have defaulted on their sovereign debt. More debt defaults could ensue in the coming months as more than a dozen countries (including Egypt, South Africa, and Sri Lanka) face acute debt distress. These countries would find it extremely difficult to refinance their existing external debt.

The EMDEs need a minimum of $3 trillion to overcome the health and economic fallout of the COVID-19 pandemic and build a sustainable recovery. Although the IMF’s $650 bn Special Drawing Rights (SDR) allocation is a welcome move and would help smaller distressed economies, it may not prove to be a game-changer for systemically important emerging markets.

The ongoing Debt Service Suspension Initiative (DSSI) by the G20/Paris Club, at best, could only provide temporary debt relief because several EMDEs are not eligible for it. Furthermore, without the participation of private creditors, the DSSI debt relief would be partial for a large number of EMDEs that owe substantial portions of debt service to private sector foreign creditors.

The “Fragile Fifteen”

Back in 2013, the “fragile five”— South Africa, Brazil, India, Indonesia, and Turkey — had high current account deficits, and a strong dependence on foreign capital inflows made them vulnerable to shifts in capital flows. Unlike 2013, this time, the normalization of monetary policy in the US could also test the vulnerabilities of EMDEs having high degrees of capital account openness and high levels of foreign currency-denominated debt.

This time, we find at least fifteen EMDEs are particularly vulnerable to global financial tightening. These are Sri Lanka, Indonesia, The Philippines, Bahrain, Egypt, South Africa, Tunisia, Zambia, Angola, Hungary, Turkey, Brazil, Colombia, Chile, and Jamaica.

These 15 EMDEs are experiencing economic difficulties due to a combination of factors, including weak domestic currencies, low forex reserves, high foreign currency debt levels, sizeable foreign ownership of domestic financial assets, a sharp fiscal position deterioration, rising inflation, and weak growth prospects. Above all, most of these countries are experiencing new waves of the COVID-19 pandemic.

It is important to note that financial and debt vulnerabilities were already visible in many of these economies before the pandemic outbreak. The pandemic has further exacerbated the existing ones and added some new sources of financial vulnerabilities. The upcoming tightening of global financial conditions could further amplify financial vulnerabilities and trigger financial crises in EMDEs.

Rising Forex Reserves: A Boon or Bane?

In the aftermath of the 1997 Asian financial crisis, many emerging markets have been accumulating large foreign exchange reserves to self-insure against volatile capital flows and other potential external shocks. There is no denying that forex reserves could play a critical role as the first line of defense when countries defend their currencies in the face of speculative attacks and exchange rate volatility. However, large forex reserves are not always better, and holding excess reserves entails fiscal costs.

The policies and management of forex reserves will vary depending upon the country’s circumstances. For instance, take the case of India, which is now the fifth-largest forex reserves holder in the world after China, Japan, Switzerland, and Russia. The large inflows of portfolio investment and FDI have led to an accretion of foreign exchange reserves that reached a historic high of $642 bn as of September 3, 2021. It includes SDR 12.5 bn (equivalent to $17.8 bn) allocated by the IMF to India on August 23, 2021.

Many analysts believe that India’s $633 bn of forex reserves would be sufficient in fighting against capital flight and currency depreciation after the onset of tapering and global financial tightening.[7] We may disagree for three key reasons.

First, the composition of India’s forex reserves is a serious cause for concern. Unlike China and many other emerging markets, India has not accumulated reserves through its current account surplus. Much of India’s forex reserves have been accumulated out of its capital account surplus. As rightly pointed out by Rakesh Tripathy of Reserve Bank of India, “reserves held by India are not truly ‘earned’, but rather ‘borrowed’ in nature, and that they may be required to be ‘returned’ should the capital flow reverse as it did during 2008–09.”[8]

The recent increase in India’s forex reserves has been mainly fueled by short-term portfolio investments in domestic equities and bond markets. Currently, foreign portfolio investors’ cumulative value of investments in the Indian markets is estimated at approx. $580 bn. Given their potentially volatile nature and destabilizing effects, portfolio flows could reverse suddenly and sharply due to the tightening of financial conditions in advanced economies, thereby putting downward pressure on India’s forex reserves and the rupee.

Second, interventions by central banks in foreign exchange markets to mitigate the impact of capital outflows on domestic currencies are considered to be most effective for a short duration (less than a month). Otherwise, the central banks run the risk of depleting substantial forex reserves without having much impact. China, for instance, spent roughly $1 trillion of forex reserves defending its currency in 2015. Hence, long-term interventions in forex markets are unsustainable.

Third, it is difficult to assess the overall quantum of capital flight during a crisis-like situation because capital can move out of India through multiple sources (including abusive transfer pricing practices and outright smuggling of foreign currency by domestic residents). Hence, these critical concerns should guide India’s approach towards managing its forex reserves, especially when dealing with spillovers of global financial shocks.

Global Monetary Cooperation is More Vital Than Ever

Ideally, in an increasingly financially interconnected world, international coordination is a prerequisite for managing the spillover effects of the monetary policies of advanced economies. Despite repeated attempts by several EM central banks to consider some rules-based international monetary policy coordination, the G7 has undermined prospects for global cooperation. Not long ago, G7 Finance Ministers and Central Bank Governors issued a statement, stating that: “We reaffirm that our fiscal and monetary policies have been and will remain oriented towards meeting our respective domestic objectives using domestic instruments.“[9]

Nonetheless, one should not miss the big picture: Increased financial fragility in systemically important emerging markets would also generate significant spillover and spillback effects on advanced economies. To illustrate, take the case of the ongoing liquidity crisis at China Evergrande Group, a debt-ridden property developer. On September 20, concerns over contagion from a possible default of Evergrande Group sparked a broad selloff in the stock markets of Europe and the US. Even the prices of Bitcoin, Etherium, and other cryptocurrencies fell sharply during the widespread market selloff and suffered an estimated loss of more than $250 bn in value.

Hence, it is imperative to develop a global collective response to manage policy spillovers and spillbacks in response to challenges posed by the growing interconnectedness of the global financial markets.

What about global financial safety nets? Could they be of any assistance to EMDEs experiencing rapid capital outflows and currency depreciation? The currency swap lines, IMF support, and regional financial arrangements could play a somewhat limited role, given their inherent limitations. For instance, only a few emerging markets that have strong financial and trade linkages with the US were offered access to ad hoc dollar swap lines in March 2020.

Many EMDE policymakers hesitate to seek support from the IMF because of the associated strict policy conditionalities and a “stigma” stemming from the fear of adverse market reactions.

In the Asian context, regional and other financial arrangements such as Chiang Mai Initiative Multilateralization (CMIM) and BRICS Contingent Reserve Arrangement (CRA) could meet short-term liquidity needs. However, their effectiveness is still unknown as these two arrangements have never been tested in a crisis.

Regulate Volatile Capital Flows

In this given scenario, where EMDEs have no control over changes in monetary policy stance in advanced economies, only a swift and decisive domestic policy response can minimize adverse effects of cross-border spillovers.

The EMDE policymakers must act early and decisively before the actual tapering process begins in the US and other advanced economies. In the near to medium term, they could undertake policy measures to minimize its impact on domestic growth sources and insulate their economies from volatile capital flows. These policies may take the form of macroprudential tools, capital controls, and currency-based measures. The proper targeting of these measures could play a vital role in reducing financial vulnerabilities.

Available evidence suggests that countries that imposed tight capital controls recovered more quickly from the 2008 global financial crisis than those with an open capital account. As noted by the IMF economists[10], EMDEs that adopted tighter macroprudential policies and capital controls before the taper talk phase of 2013 coped better with the market pressures during the taper tantrum.

Controls on outflows could be prudent to prevent abrupt capital reversals and currency depreciation, as seen in Malaysia (1998), Iceland (2008), China (2016), and Argentina (2019).[11] Further, controls on outflows are even more relevant for the poor countries that do not have large foreign exchange reserves or access to currency swap lines and regional financing arrangements.

Once capital inflows to EMDEs resume, policymakers should deploy a different set of macroprudential measures and capital controls. Since asset price boom-bust cycles are often correlated with capital flows, the EMDE policymakers could deploy ex-ante macroprudential policy tools (such as higher capital buffers, limits on loan-to-value and debt-to-income ratios) to prevent domestic asset price booms.

Such measures could be complemented by imposing capital controls on inflows in the form of restrictions on foreign ownership of domestic financial assets, limits on short-term borrowings, and imposition of a tax or unremunerated reserve requirements (URR) on certain types of capital inflows.

Controls on inflows could alter the composition of capital inflows towards longer maturities to reduce financial fragility, besides providing greater leeway to conduct an independent monetary policy. Further, these measures could reduce the need to rely on ex-post policy interventions that are often less cost-effective.

In addition, EMDEs need to strengthen regulation and supervision of their financial sector to identify potential systemic risks and risk build-up in specific sectors.

Time is of the essence. The belated policy response is akin to closing the stable doors after the horse has bolted!

Endnotes

[1] Federal Reserve Issues FOMC Statement, Press Release, September 22, 2021. Available at: https://www.federalreserve.gov/newsevents/pressreleases/monetary20210922a.htm.

[2] Fed Chair Jerome Powell Press Conference Transcript, September 22, 2021. Available at: https://www.rev.com/blog/transcripts/fed-chair-jerome-powell-press-conference-transcript-september-22-market-update.

[3] Ibid.

[4] Jerome Powell, “Thoughts on Unconventional Monetary Policy”, Speech at the Bipartisan Policy Center,Washington, DC, June 27, 2013. Available at: https://www.federalreserve.gov/newsevents/speech/powell20130627a.htm.

[5] For details, see, Kavaljit Singh, COVID-19: A Triple Whammy for Emerging Market and Developing Economies”, Briefing Paper # 36, Madhyam, April 23, 2020. Available at: https://www.madhyam.org.in/wp-content/uploads/2020/04/Briefing-Paper-36-1.pdf.

[6] Moody’s Investors Service, “Capital Outflows will Weigh on African Banks’ Financial Metrics”, April 9, 2020. Available at: https://bit.ly/3kBcaQh.

[7] See, for instance, Indranil Pan, “US Fed Tapering Impact on India Unlikely to be as Heavy as in 2013”, Money Control, September 6, 2021. Available at: https://www.moneycontrol.com/news/business/economy/us-fed-tapering-impact-on-india-unlikely-to-be-as-heavy-as-in-2013-7431721.html/amp; “India Can Weather the US Fed’s Taper”, The Financial Express, August 31, 2021. Available at: https://www.financialexpress.com/opinion/india-can-weather-the-us-feds-taper/2320668/.; Arup Roychoudhury, “The 2013 Taper Tantrum and Why Its Spectre is Being Raised Again”, Money Control, March 26, 2021. Available at: https://www.moneycontrol.com/news/business/economy/explained-the-2013-taper-tantrum-and-why-its-spectre-is-being-raised-again-6700731.html.

[8] Rakesh Tripathy, “Intervention in Foreign Exchange Markets: The Approach of the Reserve Bank of India”, Market Volatility and Foreign Exchange Intervention in EMEs: What Has Changed?, BIS Papers No 73, Bank for International Settlement, October 2013, p.174. Available at: https://www.bis.org/publ/bppdf/bispap73l.pdf.

[9] “Statement by the G7 Finance Ministers and Central Bank Governors“, G7 Finance Ministers and Central Bank Governors, February 12, 2013. Available at: https://www.bankofcanada.ca/2013/02/statement-g7-finance-ministers-central-bank-governors/.

[10] Ratna Sahay, et al., “Emerging Market Volatility: Lessons from the Taper Tantrum”, IMF Staff Discussion Note, September 2014, International Monetary Fund, p.19-20. Available at: https://www.imf.org/external/pubs/ft/sdn/2014/sdn1409.pdf.

[11] Kavaljit Singh, “Recent Experiences with Capital Controls”, Policy Brief # 4, Madhyam, May 2, 2019. Available at: https://www.madhyam.org.in/recent-experiences-with-capital-controls/; Kavaljit Singh, “The IMF Needs to be More Flexible about Capital Controls”, Letter, Financial Times, October 19, 2018. Available at: https://www.ft.com/content/347b87de-d16f-11e8-a9f2-7574db66bcd5; Kavaljit Singh, Argentina Returns to Capital Controls, Briefing Paper # 28, Madhyam, September 4, 2019. Available at: https://www.madhyam.org.in/argentina-returns-to-capital-controls/; Kavaljit Singh, Emerging Markets Consider Capital Controls to Regulate Speculative Capital Flows, Voxeu.org. Available at: https://voxeu.org/article/capital-controls-and-crisis-emerging-markets.

Image courtesy of 123rf.com